The Daily Rate Newsletter

Spring Economic Trends: Navigating the Job Market Heights and Mortgage Rate Adjustments

In today’s newsletter, we combine insights from the job market with the latest mortgage rate trends, providing you with a comprehensive view of the economic landscape as of April 2024.

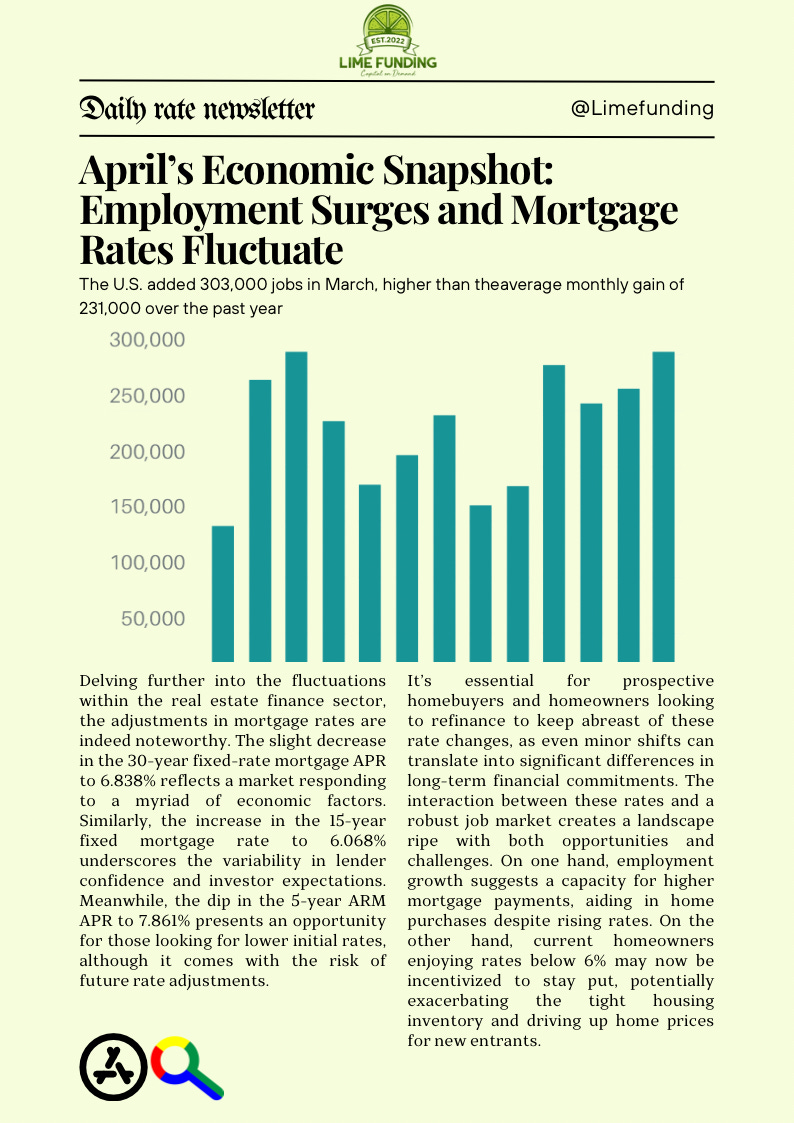

Starting with the employment sector, we’ve observed stability in the job market, with the unemployment rate maintaining at 3.8%. The economy has added a substantial number of jobs, with significant growth in sectors such as health care, government, and construction. These gains signify a resilient and expanding job market, essential for consumer confidence and spending.

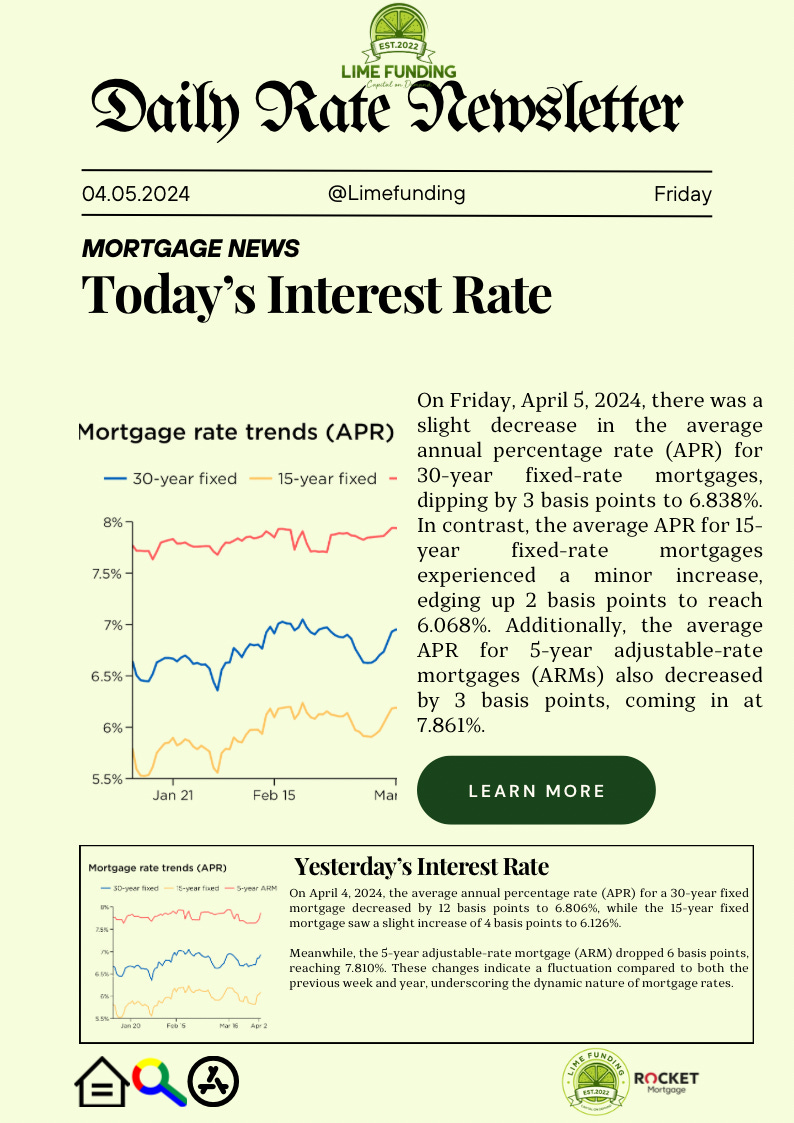

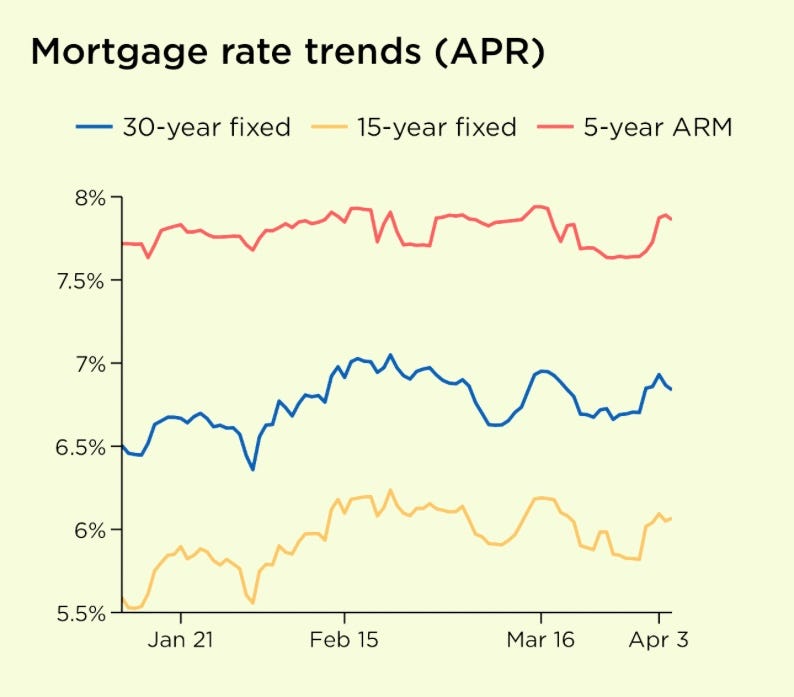

In the realm of real estate financing, there have been slight shifts in mortgage rates. As of April 5, 2024, we’ve seen a minor decrease in the 30-year fixed-rate mortgage APR, which dropped by 3 basis points to 6.838%. Conversely, the 15-year fixed-rate mortgages experienced a slight uptick by 2 basis points, bringing it to 6.068%. For those considering adjustable-rate mortgages, the 5-year ARM APR also fell by 3 basis points to 7.861%.

These mortgage rate movements are vital to track for anyone in the housing market, as they directly affect monthly payments and overall loan cost. The job market’s strength supports potential buyers’ ability to afford homes, even in a fluctuating rate environment.

Get Your Mortgage Pre-Qualification Certificate Today

This delicate balance between employment vitality and mortgage rate volatility should be a key consideration for stakeholders in the housing market, including buyers, sellers, and financial advisors. It impacts everything from affordability and borrowing costs to the overall health of the real estate market.

These mortgage rate movements are vital to track for anyone in the housing market, as they directly affect monthly payments and overall loan cost. The job market’s strength supports potential buyers’ ability to afford homes, even in a fluctuating rate environment.

We recommend keeping a close eye on both the job market and mortgage rate trends, as they are intertwined and impactful on your financial decision-making. Whether you’re seeking employment, considering a new mortgage, or planning to refinance, staying informed will help you navigate these waters effectively.

Unlock the full potential of your business with LimeFunding’s comprehensive lending solutions. Whether you’re gearing up for growth, eager to expand, or simply smoothing out cash flow, our tailored business loans provide the financial springboard your company needs.

With LimeFunding, experience the advantage of:

Competitive Rates: Secure your financial future with our attractive interest rates, designed to keep your costs down.

Flexible Terms: Choose a repayment plan that fits your business cycle and cash flow, ensuring you can focus on what you do best – running your business.

Swift Approvals: Time is money. Our streamlined application process means you get the funds you need, when you need them.

Expert Support: Our dedicated financial advisors are on hand to guide you through the loan process, offering personalized advice every step of the way.

Whether it’s launching a new product line, investing in state-of-the-art equipment, or funding your next big project, LimeFunding is your partner in growth. Let’s build your business success story together. Contact us today and take the first step towards your business’s financial freedom.

Stay tuned for more updates and detailed analysis in our next newsletter.